dupage county sales tax vs cook county

1337 rows 2022 List of Illinois Local Sales Tax Rates. Dupage county vs cook county.

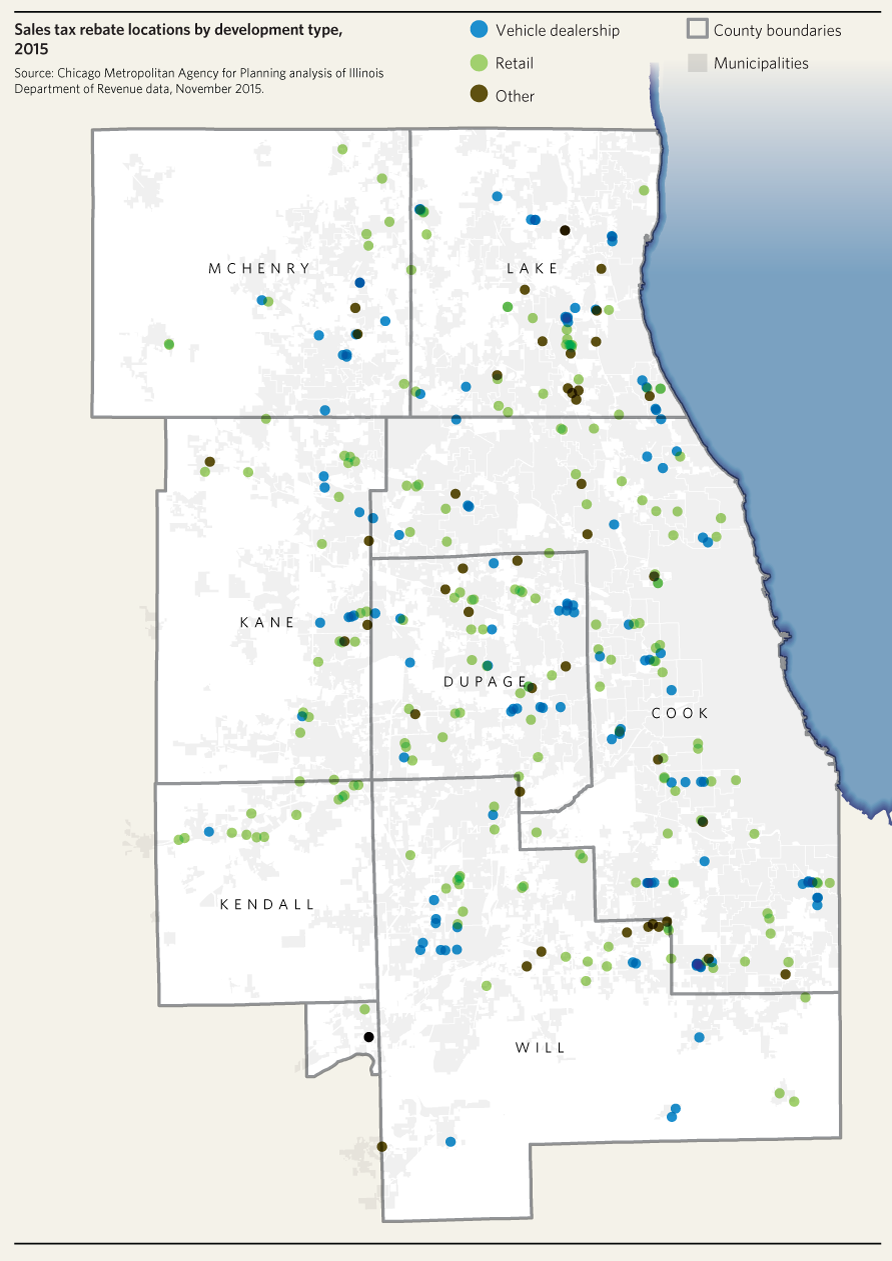

Sales Tax Rebates Remain Prevalent In Northeastern Illinois Cmap

1516 Church Street Stevens Point WI 54481 715 346-1364.

. Average Sales Tax With Local. Lowest sales tax 625 Highest sales tax 115 Illinois Sales Tax. Here are the Top 10.

The base sales tax rate in DuPage County is 7 7 cents per 100. These rates were based on a tax hike that dates to 1985. The minimum combined 2022 sales tax rate for Dupage County Illinois is.

Main Street Belvidere IL 61008. In 2018-2019 more than one-in-seven 150 percent kindergarten sixth and ninth grade public school students in DuPage County had obesity. Hinsdale is just flat out high taxes.

Thanks to the DuPage County sales tax reduction the new rate for services and parts is 75 and the new rate for. Illinois has a 625 sales tax and Dupage County collects an additional. Side-by-side comparison between Cook county IL and DuPage county IL using the main population demographic and social indicators from the United States Census.

Dupage county vs cook. The base sales tax rate in DuPage County is 7 7 cents per 100. What is the sales tax rate in Dupage County.

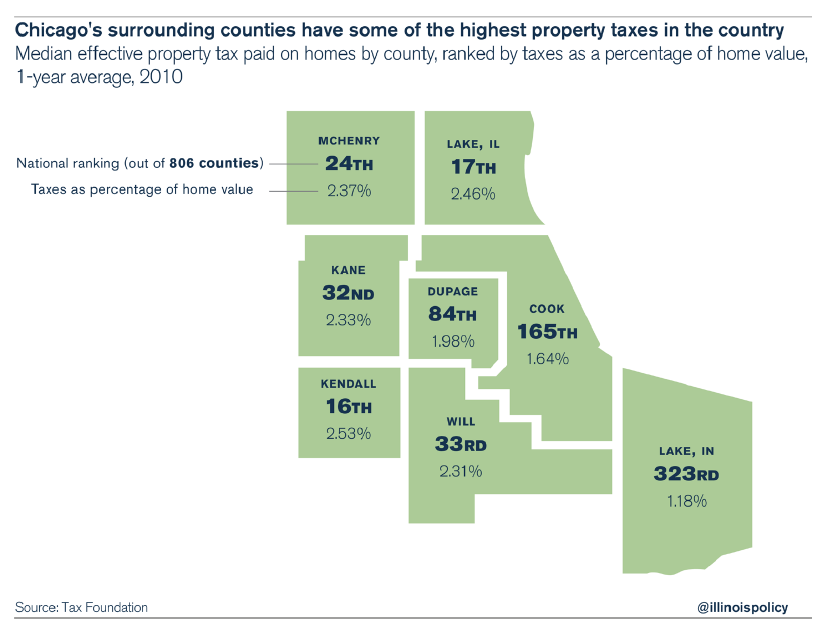

The average bill in DuPage County is higher than nearly 98 percent followed by Kane County and McHenry County both 96 percent Cook County 94 percent and Will. Indianas state gas tax is a little higher than Illinoiss but in Illinois the city and county often add additional taxes so that the combined is higher than oursChicago and Cook County being one. So if a county website says the average tax rate for the county is 75 per hundred dollars of value a builders sales rep will probably say that the rate is 25 25 per hundred dollars of.

Email protected If time sensitive please call 715-346. People are mentioning taxes. 11 Marshall County IL.

Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a. At the time the average rate for Cook County including municipal sales tax was about 216 percentage points higher than in DuPage Kane Lake McHenry and Will counties. Clerk of Courts Website.

Recently I looked online at a 2 flat in a Cook County suburb and nearly fell out of my chair when the real estate agent told me what the property taxes were. Cook has higher sales taxes but both Cook and DuPage have higher property taxes depending on which town youre in. County Farm Road Wheaton Illinois 60187.

Clerk of the Circuit CourtsLisa M. These county jails do not have an inmate search online system you can contact a jail to lookup inmates. Median Annual Property Tax Payment.

The current total local sales tax rate in DuPage County IL is 7000. If your Property Taxes are Sold at the Annual Tax Sale Held on November 1718 2022. This is the total of state and county sales tax rates.

Illinois has a 625 sales tax and Cook County collects an additional 175 so the minimum sales. PLEASE CONTACT THE DU PAGE COUNTY CLERK AT 630-407-5500 for an Estimate of Redemption. Dupage county vs cook county1959 nascar standings dupage county vs cook county.

Dupage County Illinois Sales Tax Rate 2021 -. The December 2020 total local sales tax rate was also 7000. The total sales tax rate in any given location can be broken down into state county city and special district rates.

I am in Dupage and. Average Effective Property Tax Rate.

2022 Community Data Snapshots Cmap

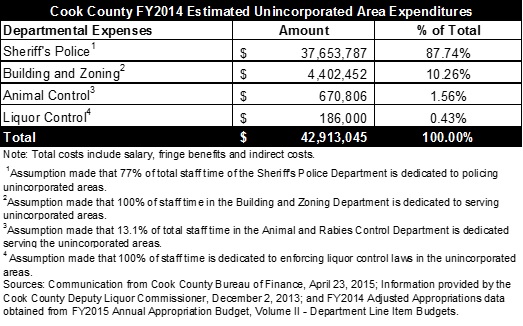

Cook County Property Taxes Due August 1 2018 Fausett Law Offices

Cook County Increases Its Sales Tax By One Percentage Point The Civic Federation

Chicago Area Property Taxes Higher Than 93 Percent Of Biggest Counties Crain S Chicago Business

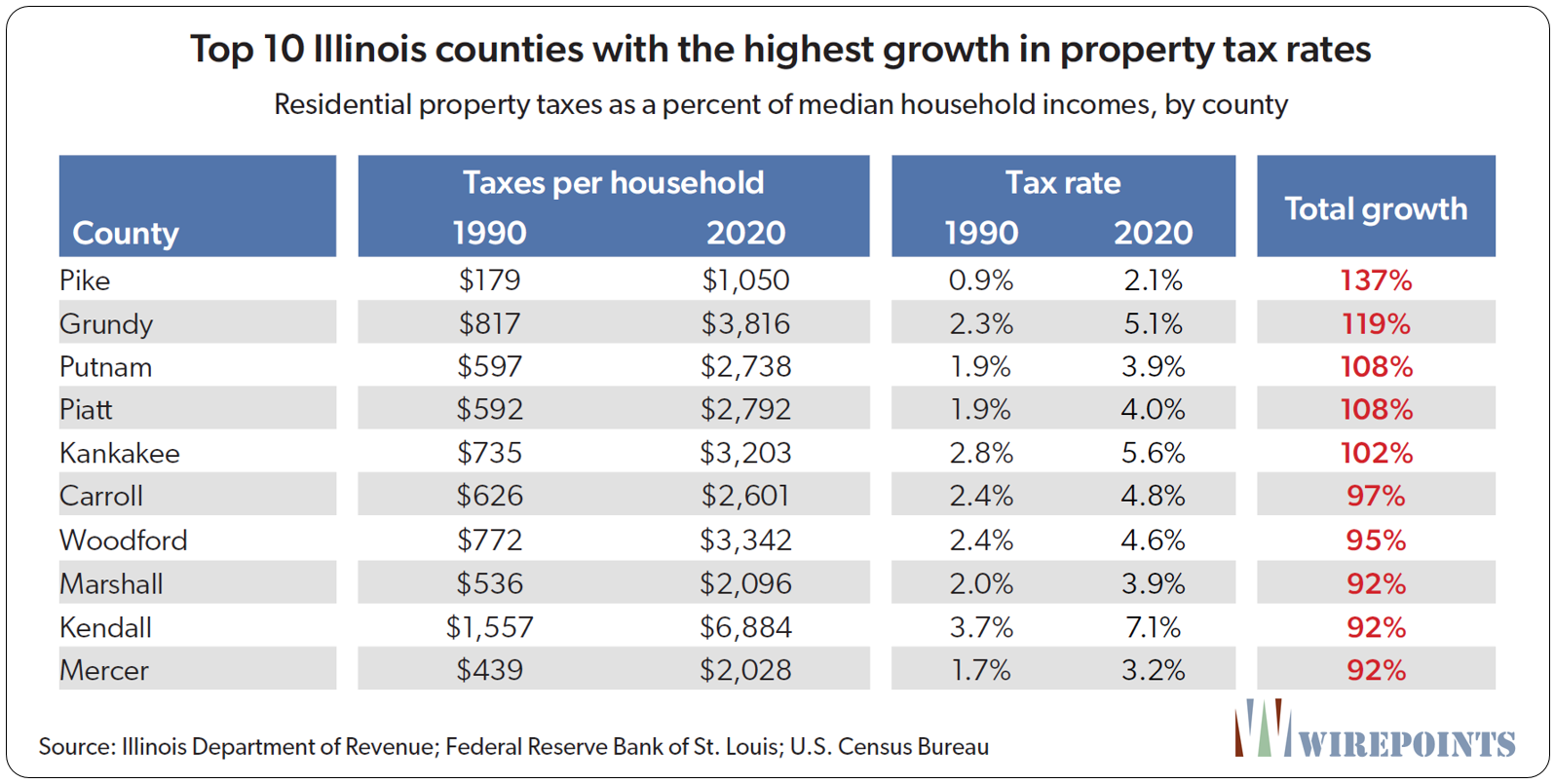

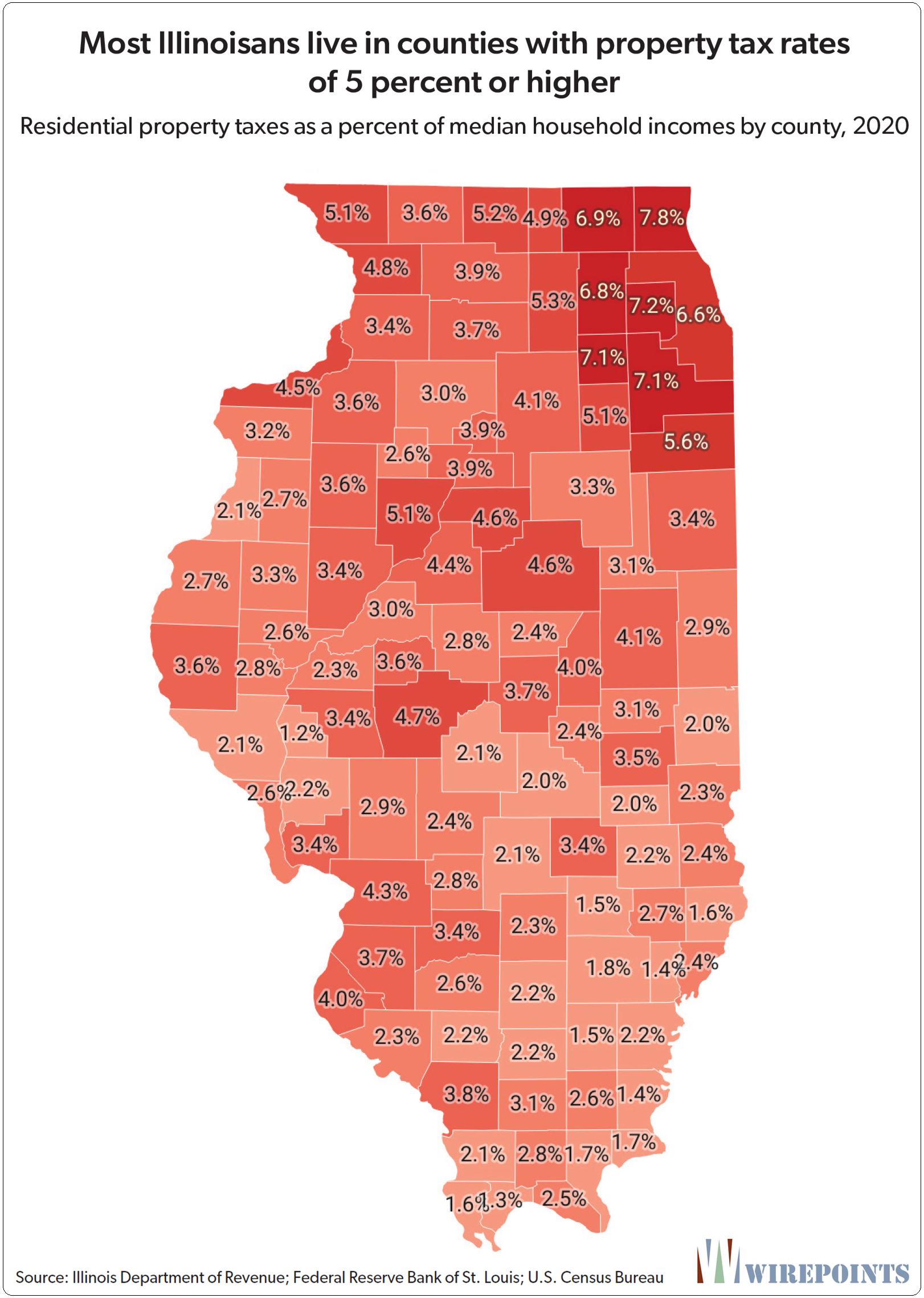

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record

Busting The Myth That Chicago Taxes Are Low Illinois Policy

List Of Real Estate Tax Exemptions In Dupage County

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

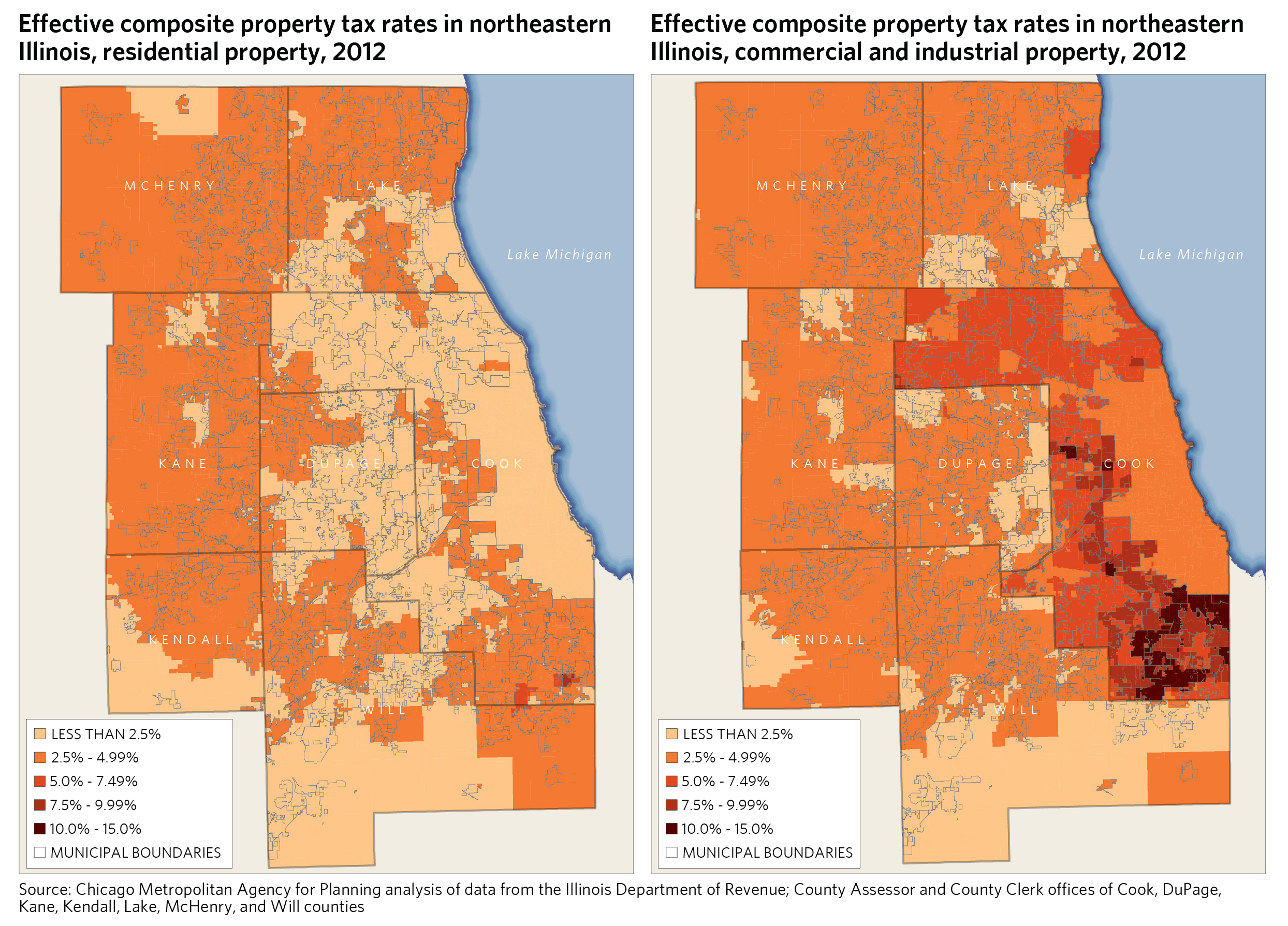

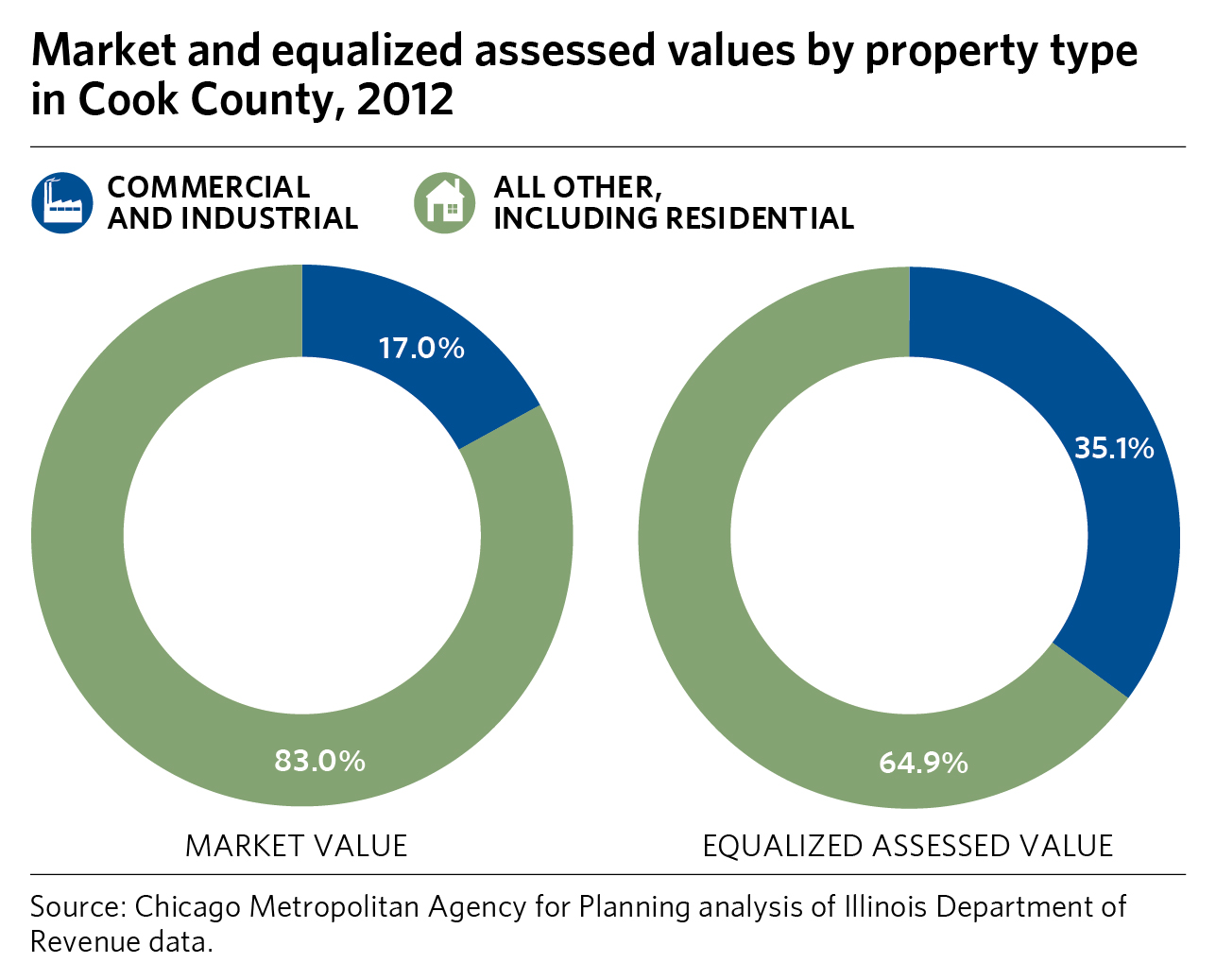

Cook County Property Tax Classification Effects On Property Tax Burden Cmap

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Dupage County Il County Board District Map

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

The Story Of Why Real Estate Taxes Are Paid In Arrears And How Property Tax Prorations Work Chicago Real Estate Closing Blog

Dupage Property Tax Due Dates Fausett Law Office

Cook County Property Tax Classification Effects On Property Tax Burden Cmap

Dupage County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More